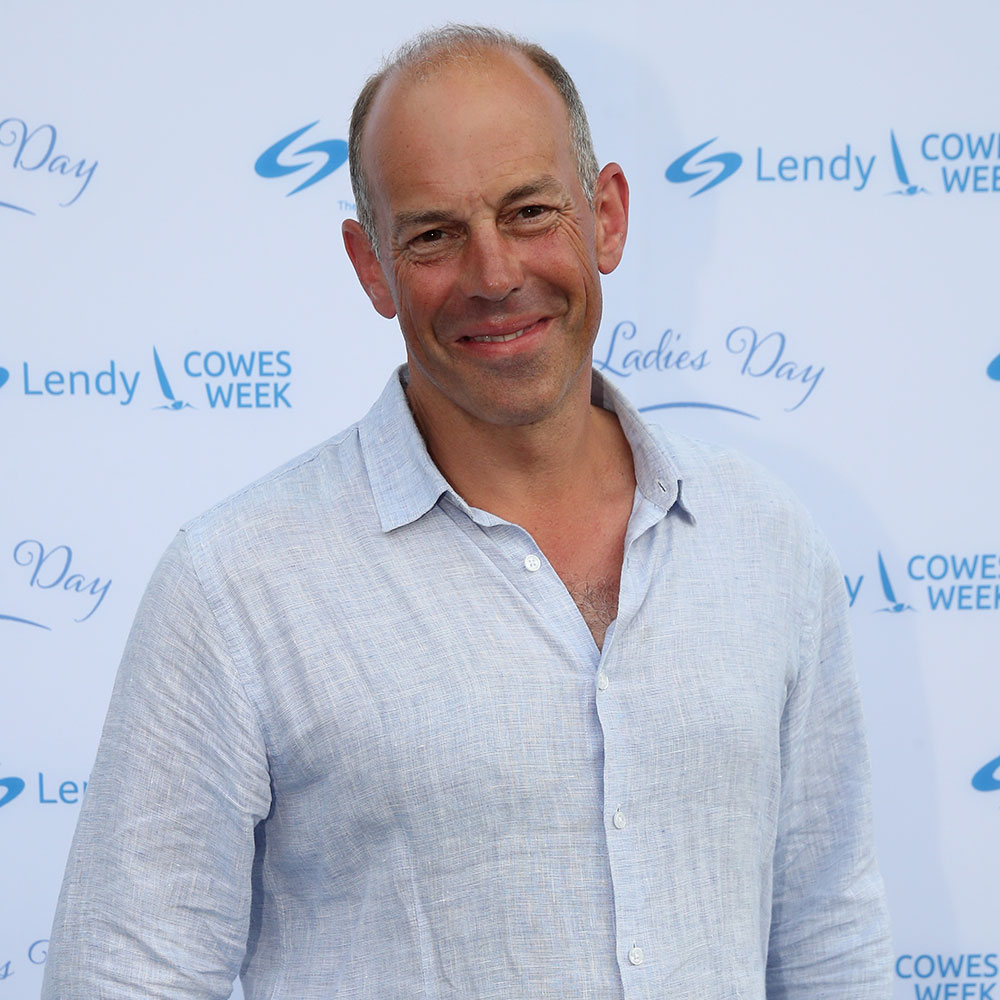

Phil Spencer has this warning if you're trying to apply for a mortgage right now

He discussed the issues of home financing on his latest MoveIQ vlog

Sign up to our newsletter for style inspiration, real homes, project and garden advice and shopping know-how

You are now subscribed

Your newsletter sign-up was successful

It could be harder to get a mortgage right now. Especially if you are self-employed or work in a job that pays on the basis of bonuses and commission, according to Phil Spencer.

Related: Martin Lewis warns despite stamp duty cuts now might not be good time to buy - here's why

Phil was talking to mortgage expert Alex Smith from Capricorn Financial on his latest MoveIQ vlog, and asked if he thought it was harder for people to get a mortgage.

Is it harder to get a mortgage if you're self employed?

'The self employed have a far bigger degree of scrutiny around their finance now,' says Alex, who explains the questions that underwriters want answering.

'Have they taken any Government support, such as bounce back loans, or have they furloughed themselves? Those are the questions that are asked, and the underwriter then determines whether they are comfortable underwriting that mortgage on that information.'

'For larger loans to the self-employed, there's a little bit more risk than there used to be – last year, [underwriters] would have been more confident in the systems for verifying income.'

Is it harder to get a mortgage if you've been on furlough?

'What's the state of play for employed people, rather than self-employed people,' asks Phil. 'Will the underwriters look at the business that they work for?'

Sign up to our newsletter for style inspiration, real homes, project and garden advice and shopping know-how

'We've had some examples of where there have been announced redundancies and we're asked, "has the borrower been told anything?" But they're not looking too much into the employer,' Alex replies.

'People that have been furloughed should now be back, and as long as they have a latest payslip that shows they are back on full pay, or a letter from the employer to show they are going back, then that's fine.'

Is it hard to get a mortgage if you get paid on a bonus scheme?

'Employed people are not as impacted as the self-employed, but variable pay is a problem,' says Alex. 'Bonuses and commission, with some lenders, are not being considered at all.'

'You'll find that if you're a key worker you'll be fine with overtime and things like that, but lump-sum annual bonuses are under question.'

'What about the "Bank of Mum and Dad"?' asks Phil. 'Someone told me that has been under question, and that if money had been gifted or even lent by a member of the family, the banks were looking more carefully at that now. Is that the case?'

'The main one would be Nationwide, where you're looking to borrow 90%. Only 25% of your deposit should come as a gift. The rest has to be saved by the individual. That's something that only applies to the 90% loan-to-value products.

But with larger deposits, they don't have the same requirements. So yes, it is under scrutiny, but not as much as perhaps is thought.'

Do the banks want to lend money?

'Where would you say is the banks' general attitude to lending?' Phil asks. 'Obviously banks are in the business to lend money – they want to lend money. But are they keen to lend money, where are they at, because a lot of mortgage products have been pulled.'

'I think they are keen to lend,' says Alex. 'We do have a strange situation with certain loan-to-values – 80%, 85% – that the interest rates are creeping up. There's a tendency to not be market leading. No one wants to be market leading because they get an influx of business.

'And I think that's the biggest challenge that banks have... trying to keep the interest rates sensible. Banks do want to lend, yes. There's a lot more to consider, with lending, because the economic outlook is unknown.'

More words of wisdom from Phil: Phil Spencer reveals his prediction for house prices in 2021

'Once banks have Q3 and Q4 data and see the impact of the furlough scheme – whether employers take back most of their workforce and the impact on unemployment levels – then hopefully in Q1 next year we will have a more optimistic view in terms of lending. So cheaper borrowing rates, and hopefully more higher LTV mortgages.'

Amy Cutmore is an experienced interiors editor and writer, who has worked on titles including Ideal Home, Homes & Gardens, LivingEtc, Real Homes, GardeningEtc, Top Ten Reviews and Country Life. And she's a winner of the PPA's Digital Content Leader of the Year. A homes journalist for two decades, she has a strong background in technology and appliances, and has a small portfolio of rental properties, so can offer advice to renters and rentees, alike.