Over 50s unknowingly sitting on the equivalent of over £56k worth of unused space in their homes

In a world where living space is at a premium, the costs are high

Sign up to our newsletter for style inspiration, real homes, project and garden advice and shopping know-how

You are now subscribed

Your newsletter sign-up was successful

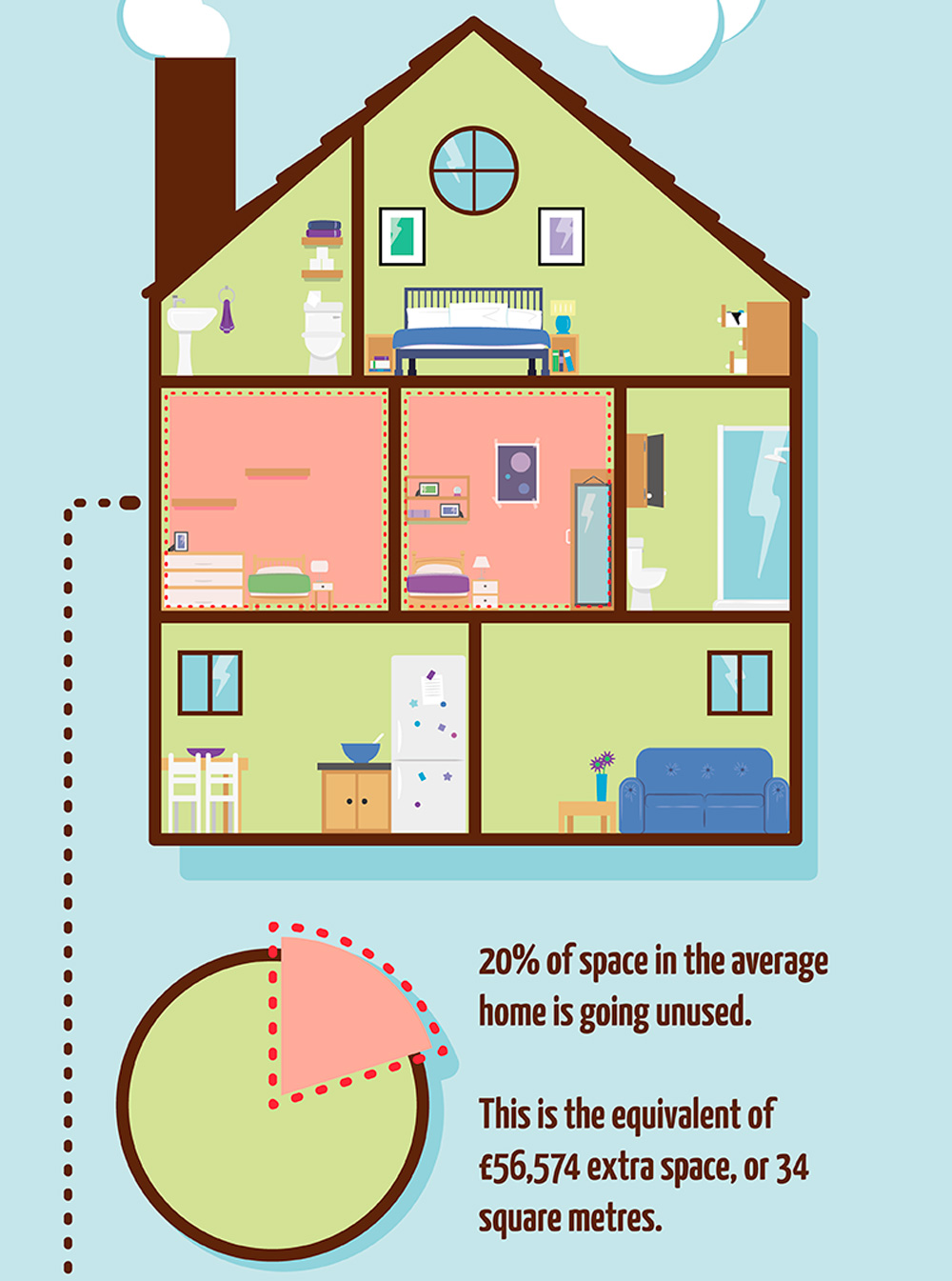

Ever consider the financial value of unused space in your home? Startling new research reveals the average adult, aged over 50 in the UK, is sitting on the equivalent of £56,574 worth of unused space in their home.

The study found once kids have flown the nest, the older generation are left with 34 square metres of empty space in their homes.

With the average house price being valued at £276,393, each square metre equates to the value of £1,669.

Related: This is EXACTLY how much storage space you get in new-build homes - and it might shock you!

'Our survey found there is plenty of space in the family homes of empty nesters which is going to waste, and it's not just space - but possible financial wastage, ' explains Mark Gregory, founder and CEO of Equity Release Supermarket, who commissioned the research.

With typically two unoccupied rooms, two fifths claim their house feels emptier now their children have moved out.

It's only after two years and seven months many seize the opportunity to transform the space. Typically into a gym, home office or even the craft room they’ve always dreamed of.

Sign up to our newsletter for style inspiration, real homes, project and garden advice and shopping know-how

The study revealed 38 per cent of respondents dream of luxurious locations and spending their money on holidays to make the most of their retirement.

However half of those surveyed said they do worry about their financial security in the future.

Mark goes on to say, 'The research highlighted that many over 50s are effectively sitting on thousands of pounds of wasted space. The aid of equity release could be used to ease people’s financial situation, enhance retirement or enable them to explore various other opportunities in later life.'

While the average over 50 is safe guarding £18,113 in their bank account, a third of respondents admit having less than £7,500 in savings – leaving them with a smaller safety net beyond their pension or other assets.

The study, conducted via OnePoll, also revealed one in 10 are considering dipping into their pension pot early to support their lifestyle, while 15 per cent have debating selling possessions.

Only 12 per cent are considering releasing equity from their property, to stabilise their financial future. Compared to a third who have contemplated downsizing.

'Many people don’t understand the features and benefits of equity release as a possible solution to support retirement,' explains Mark.

All you need to know: Equity release – a guide to accessing the cash tied up in your home

'Therefore, taking equity out on their home is not always the first port of call, and they end up opting for alternatives that may not be the best option to suit their circumstances.'

“Whilst it’s not the only option to raise capital for an enhanced retirement, equity release could be beneficial and should always be considered with the right financial advice.”

Tamara was Ideal Home's Digital Editor before joining the Woman & Home team in 2022. She has spent the last 15 years working with the style teams at Country Homes & Interiors and Ideal Home, both now at Future PLC. It’s with these award wining interiors teams that she's honed her skills and passion for shopping, styling and writing. Tamara is always ahead of the curve when it comes to interiors trends – and is great at seeking out designer dupes on the high street.