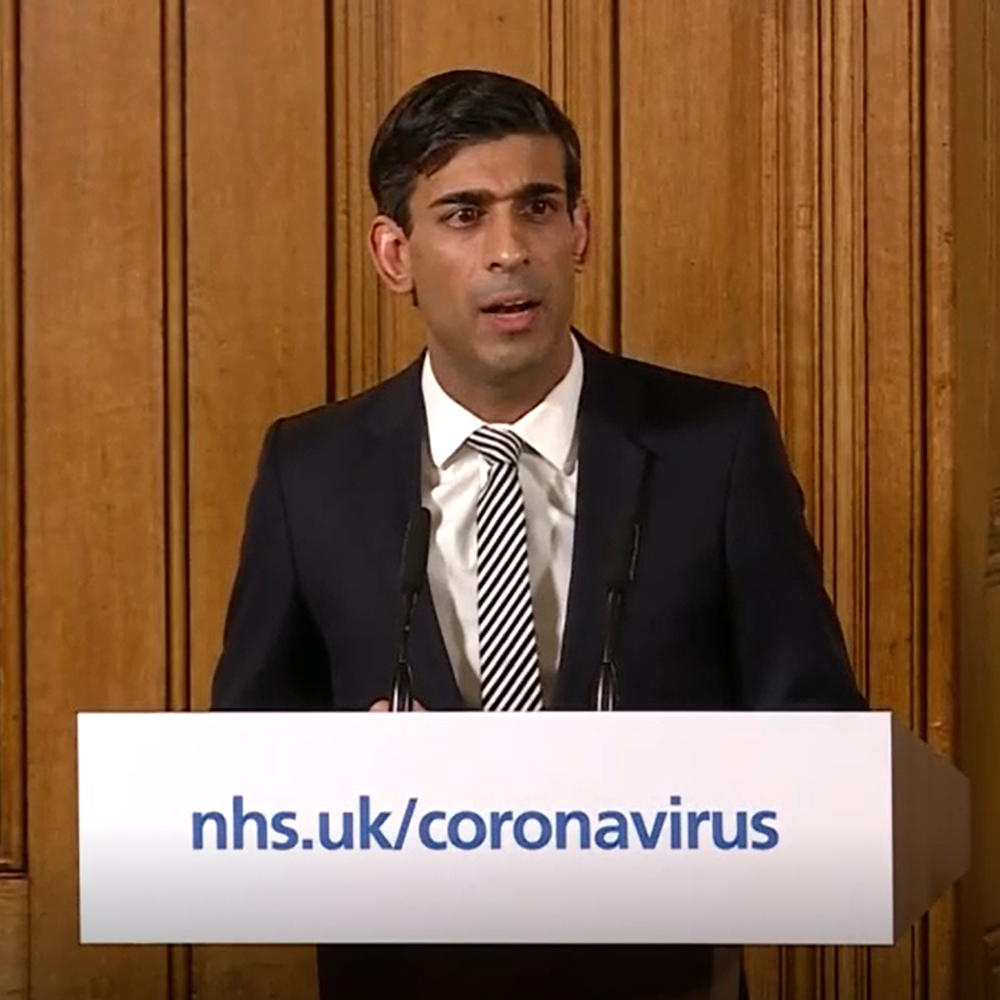

Chancellor announces the return of 95 per cent mortgages - everything you need to know

The Chancellor has confirmed the launch of 95 per cent government-backed mortgages

Sign up to our newsletter for style inspiration, real homes, project and garden advice and shopping know-how

You are now subscribed

Your newsletter sign-up was successful

Rishi Sunak has confirmed the launch of a 95 per cent mortgage guarantee scheme aimed to restore the availability of 95 per cent mortgages.

Following the Prime Minister's intent to 'turn generation rent into generation buy' several months ago, Sunak has announced that the new scheme will launch in April 2021 and run until September 2022.

How will the mortgage guarantee scheme work?

The mortgage guarantee scheme will be guaranteed – or backed – by the government, which removes the risk for lenders who have been reluctant to offer high-LTV (loan-to-value) mortgages in the wake of the Covid-19 pandemic. In fact, most major lenders stopped offering 95-per-cent mortgages altogether during the second half of 2020, making buying a house impossible for many.

The scheme will be restricted to properties with a value of up to £600,000 but won't be restricted to first-time buyers or specific property types, like the Help to Buy scheme is. Theoretically, it could cover a huge number of buyers – the house value cap only excludes about 14 per cent of properties sold in the UK – but industry experts are already predicting issues with the scheme.

Will the scheme really help first-time buyers?

The most important issue around the scheme is that it may not help that many first-time buyers. While several of the country's big lenders, including Lloyds, Natwest, Santander, Barclays and HSBC have committed to start offering these mortgages from April, they will not be required to relax their lending criteria in order to do so.

Most mortgage lenders will only lend up to 4.5 times an average salary. This means that in areas with more expensive housing, the 95 percent loan will require a vast annual salary (over £100,000 in London).

Sign up to our newsletter for style inspiration, real homes, project and garden advice and shopping know-how

CEO of Enness Global Mortgages, Islay Robinson commented: 'Although many big lenders have committed to the government’s announcement today, it will be interesting to see just how many buyers are able to secure such a product when it comes to actually applying.'

The other likely issue with the scheme is that it will put even more pressure on the market, pushing up house prices further. Marc von Grundherr, Director of lettings and estate agent Benham and Reeves, commented: 'To roll this sort of counterproductive initiative out to the whole of the market wouldn’t be so bad if the government also addressed the issue of supply. If you have trouble climbing the stairs you need to add a handrail, not increase the size of the staircase. However, the government has, yet again, chosen to do just this.'

Related: Phil Spencer has this warning if you're trying to apply for a mortgage right now

We will just have to wait and see what happens next month when the scheme launches.

Anna Cottrell is Consumer Editor across Future's home brands. She moved to the world of interiors from academic research in the field of English Literature and photography. She is the author of London Writing of the 1930s and has a passion for contemporary home decor and gardening.